About us

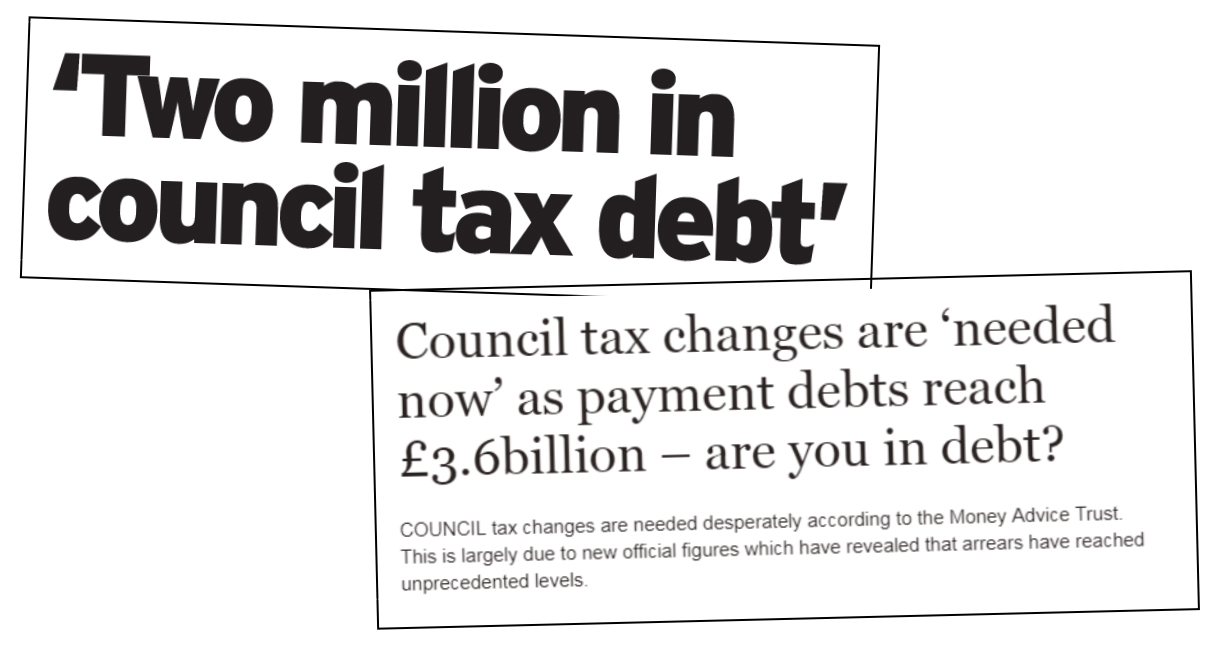

The Money Advice Trust helps people across the UK to tackle their debts and manage their money with confidence.

What you’ll find on this page: Our team, trustees and ambassadors, Our outcomes and annual reports, Careers, Media centre, Contact us, and Latest news

Our team, trustees and ambassadors

The Money Advice Trust is led by a senior leadership team and wider management team. We also benefit from the knowledge and experience of a president, ambassadors and trustees who offer their time to help us achieve our vision.

A YEAR LIKE NO OTHER

OUR 2020

Our outcomes and annual reports

Last year was another busy year for the Money Advice Trust, as we helped people across the UK to tackle their debts and manage their money with confidence.

A YEAR AT THE TRUST

IMPROVING, INNOVATING AND INFLUENCING

Careers

We are an influential national charity that helps hundreds of thousands of people each year to tackle their debts and manage their money with confidence.

Help us to continue making a difference to people’s lives by joining our friendly team.

Media centre

We deal with a range of media requests and can offer help to journalists writing, researching, recording and filming stories.

Contact us

From media enquiries to adviser support, to contacting our HR or research and policy teams, you’ll find our full list of contact details here.