Vulnerability training

Find out more about the courses we offer to staff in financial services, energy, water and other creditor sectors.

Excellence in Training & Best Vulnerable Customer Support Initiative Winner 2024

The Money Advice Trust won the Excellence in Training award and the Best Vulnerable Customer Support Initiative award at the 2024 CCS awards.

The awards recognises the impact of our training work with creditors to improve support for vulnerable customers.

Our training and consultancy 2025

We’ve worked in the area of vulnerability since 2011 and have helped over 450 firms, and more than 53,000 staff to deliver the best experience, support and outcomes for their customers. You can download information on our training and consultancy services here.

Supporting customers in vulnerable circumstances

Health, disability, unemployment, bereavement, domestic violence and addiction can all contribute to making someone more vulnerable.

Customers in vulnerable circumstances are especially susceptible to detriment. Your staff need to know how to identify and work with these customers in a way that is both consistent and fair.

This can have a positive impact on your ability to recover debts, employee morale and your reputation as a responsible organisation.

We also offer a refresher course which ensures your staff maintain their knowledge by reinforcing the training they have previously received.

Course outline

Aim: To help your staff understand the steps and actions they need to take in order to identify and work with customers in vulnerable circumstances.

Who is it for? All front-line, customer-facing staff, management, specialist teams, back-office staff and relevant suppliers.

Training options available

City & Guilds Assured

Our virtual classroom and face-to-face training options have achieved the City & Guilds Assured quality mark. Creditors who complete this training will be awarded a digital credential, which they can use to evidence their knowledge and skills required to identify, communicate, and support a vulnerable customer. Find out more about our City & Guilds Assured training courses and its benefits here.

What’s covered?

- Key factors that may impact on vulnerability and categories of vulnerability

- Statutory principles under the Mental Capacity Act, including which individuals may act in a legal capacity for the person in debt

- The TEXAS protocol for handling disclosure of sensitive personal information

- The four points of the Compass technique as a tool for understanding the significance of the vulnerability presented

- Different pathways for debtors to obtain free, independent, money advice

Benefits to you

- Improve your reputation as a responsible organisation that treats customers fairly

- Gain the skills, tools and confidence to handle customers in vulnerable circumstances fairly and consistently

- Improve your debt recovery rates and broken repayment arrangements, and minimise the likelihood of additional costs

- Meet your legal and regulatory responsibilities under the Mental Capacity Act and Data Protection Act

- Supports all parts of your business (lending, customer service, fraud, retention, collections and digital)

Supporting customers in vulnerable circumstances

Health, disability, unemployment, bereavement, domestic violence and addiction can all contribute to making someone more vulnerable.

Customers in vulnerable circumstances are especially susceptible to detriment. Your staff need to know how to identify and work with these customers in a way that is both consistent and fair.

This can have a positive impact on your ability to recover debts, employee morale and your reputation as a responsible organisation.

Effective refresher training is essential as it ensures your staff maintain their knowledge by reinforcing the training they have previously received; it reduces the risks of mistakes by reminding staff of the key techniques to support vulnerable consumers and it helps to foster a culture of continuous learning.

We can work with you and your organisation to develop a half-day refresher session for your staff. It reminds them of the models to use, such as IDEA and TEXAS and ensures they are clear on their responsibilities when supporting your vulnerable consumers.

Course outline

Aim: The aim of this course is to provide learners with a refresher of the skills required to identify and understand the needs of vulnerable consumers and support them.

Who is it for? This course is intended for those who are in consumer-facing roles that are likely to encounter and interact with vulnerable consumers.

Training options available

City & Guilds Assured

Our virtual classroom and face-to-face training options have achieved the City & Guilds Assured quality mark. Creditors who complete this training will be awarded a digital credential, which they can use to evidence their knowledge and skills required to identify, communicate, and support a vulnerable customer. Find out more about our City & Guilds Assured training courses and its benefits here.

What’s covered?

- The exact objectives for this course will be agreed with you to meet your needs. Below is an example of some of the objectives we can help you to achieve:

- What to do when dealing with challenging interactions and specific tools and techniques for handling these

- Recognise the impact of a trigger in your customer or yourself

- Identify and set important personal and organisational boundaries

- Ways to de-escalate a challenging situation

- Reflect on your own advice practice and ways to develop this

- How to effectively signpost a customer without causing further distress

Benefits to you

- Improve your reputation as a responsible organisation that treats customers fairly

- Gain the skills, tools and confidence to handle customers in vulnerable circumstances fairly and consistently

- Improve your debt recovery rates and broken repayment arrangements, and minimise the likelihood of additional costs

- Meet your legal and regulatory responsibilities under the Mental Capacity Act and Data Protection Act

- Supports all parts of your business (lending, customer service, fraud, retention, collections and digital)

Supporting bereaved customers

To help creditors and frontline staff support bereaved customers, The Money Advice Trust has partnered with Cruse Bereavement Care, the leading national charity for bereaved people in the UK.

Around 1,500 people die in the UK each day, and on average 22 organisations must be contacted following each death. Essential service providers are likely to encounter someone going through a difficult time because of bereavement.

This e-learning will offer you an insight into what your customer may be experiencing both practically and personally and enhance your ability to support them effectively.

Course outline

Aim: To help your staff understand how a vulnerable situation can be created or made worse by the loss of a loved one, and what financial organisations can say or do to support people going through these difficult times.

Who is it for? All frontline, customer-facing staff, management, specialist teams, back-office staff and relevant suppliers.

Training options available

E-learning

“Front line staff often worry about saying the ‘wrong thing’ and can be unsure what action is best. We have developed Supporting Bereaved Customers to help staff understand the impact of grief, how it may lead to vulnerability and what financial organisations can do to support customers following the death of a loved one.“

– Kirsty Hunt, Training and Consultancy Manager, Cruse Bereavement Care

What’s covered?

- How bereavement and grief can create or exacerbate vulnerable situations

- Helpful phrases and communication skills to use when working with bereaved customers

- Where to signpost people when they need further support

- Ways to practice self-care when personally affected by bereavement.

Benefits to you

- Improve your reputation as a responsible organisation that supports customers through life-changing situations and difficult times

- Gain the skills, tools and confidence to support customers experiencing bereavement fairly and consistently

- Meet regulatory expectations under the FCA vulnerability guidance in relation to significant life events

- Improve your reputation as an employer who supports both their staff and customers.

Want to find out more about Cruse Bereavement Care and Bereavement?

Listen to our free ‘Dealing with customer bereavement‘ podcast, recorded last year as part of our ‘Working In A Crisis’ series featuring Andy Langford, Clinical Director at Cruse Bereavement Care.

Data, GDPR and vulnerability

Data lies at the heart of the FCA’s vulnerability regulations.

Firms need to evidence that the outcomes of vulnerable consumers are as good as those of other consumers.

Firms need to know their vulnerable consumers, hold the right data about them, and use this to help and support them. Firms need to balance the FCA’s expectations on data with those of the ICO, the GDPR, and the Data Protection Act 2018. This course has been developed to address these specific requirements and provide your firm with the knowledge to make sure you meet your responsibilities.

Course outline

Aim: The aim of this course is to provide learners with knowledge to understand how GDPR and vulnerability interact and how to record the required information for vulnerable customers.

Who is it for? Data protection teams, staff working on vulnerability policy, operational and compliance leads/specialists.

Training options available

What’s covered?

You’ll explore the following topics:

- Processing data (GDPR requirements)

- The challenges of supporting vulnerable customers and meeting GDPR requirements

- What basis can we process data under

- Additional considerations

- Applying GDPR principles to customer scenarios

Benefits to you

By the end of this course, learners will be able to:

- Identify the challenges of supporting vulnerable customers and meeting GDPR requirements

- Gain the skills, tools and confidence to handle customers in vulnerable circumstances fairly and consistently

- Improve your reputation as a responsible organisation that treats customers fairly

- Explain the different basis under articles 6 and 9 that can be used to record customer disclosures

- Apply the principles from GDPR to a range of vulnerable customer scenarios.

- Meet your legal and regulatory responsibilities.

Outcomes and Vulnerability

Every regulator wants firms to achieve outcomes that are as good for customers in vulnerable circumstances as they are for customers who are not. And firms not only need to deliver this, but also need to demonstrate how they do it, and show how they know those outcomes are as good.

This course will give you the tools to help you do that, using a simple but effective Outcomes Model that has been developed using regulator insight and best practice from across the financial services industry.

Participants will work through a series of facilitated sessions, case studies, and interactive debates to bring the Outcomes Model to life, taking participants through a clear step by step in the outcome process from definition and measurement to analysis and impact.

We recognise that working on outcomes is usually simpler to describe on paper than deliver in practice, and this course aims to give practical hints and tips to bring it to life in the real world.

Course outline

Aim: The aim of this course is to provide learners with knowledge and skills to design products and journeys which meet the needs of all customers, particularly vulnerable customers.

Who is it for? Product design and marketing teams, vulnerability specialists or anyone whose role involves championing the needs of customers in vulnerable circumstances.

Training options available

What’s covered?

By the end of this session, learners will:

- Be able to meet legal and regulatory requirements relating to consumer outcomes.

- Understand how to define and deliver appropriate consumer outcomes, and evaluate whether those outcomes have been achieved.

- Identify ways to strengthen their organisation’s reputation as a responsible business that treats customers fairly.

- Develop a practical approach to improving their own work on consumer vulnerability

Benefits to you

By the end of this course, learners will be able to:

- Define what inclusive design is and why it is important when designing products for customers

- Identify what good inclusive design looks like

- Apply inclusive design principles to a product development project

- Improve your reputation as a responsible organisation that treats customers fairly

- Meet your legal and regulatory responsibilities.

Supporting customers with mental health conditions

Every year one in four adults will experience a mental health problem.

Being aware of the range of mental health conditions and their impact is a vital part of understanding your customers and achieving the right outcomes for your organisation or business.

Course outline

Aim: To provide learners with skills needed to identify and support customers with mental health conditions.

Who is it for? All front-line, customer-facing staff, management, specialist teams, back-office staff and relevant suppliers.

Training options available

What’s covered?

- What a mental health condition is

- Why it is important to identify mental health conditions and the impact they can have on a customer

- The difference between a range of mental health conditions

- Why customers may not disclose their mental health condition

- How to respond when a customer makes an initial disclosure

- Other techniques for helping customers with different mental health problem

Benefits to you

- Improve your reputation as a responsible organisation that treats customers fairly

- Gain the skills, tools and confidence to handle customers in vulnerable circumstances fairly and consistently

- Improve your debt recovery rates and broken repayment arrangements, and minimise the likelihood of additional costs

- Meet your legal and regulatory responsibilities under the Mental Capacity Act and Data Protection Act

- Supports all parts of your business (lending, customer service, fraud, retention, collections and digital)

Building personal resilience

Firms and their staff play a crucial role in supporting customers in vulnerable circumstances.

However, staff can sometimes be presented with difficult situations that over time can have an effect on their wellbeing both emotionally and professionally.

It is important for your workplace to have measures in place to support your staff so that they can help your customers effectively.

Course outline

Aim: To provide your staff with the knowledge and practical steps on improving their personal resilience.

Who is it for? All frontline, customer-facing staff, management, specialist teams, back-office staff and relevant suppliers

Training options available

Virtual classroom

Public session

What’s covered?

- Why people react the way they do

- Identifying and exploring personal boundaries and triggers

- Practical steps to take when you are in ‘the moment’

- Looking after yourself both during and after an interaction with a vulnerable customers

Benefits to you

- Improve your reputation as a responsible organisation that treats staff and customers fairly

- The course is hosted online, providing you with a flexible schedule and environment to suit your staff as they can attend from anywhere

- Improve your overall workplace environment with a more resilient workforce and organisation which can result in increased productivity

- Improve your reputation as an employer who supports staff

- Reduction in staff sickness levels

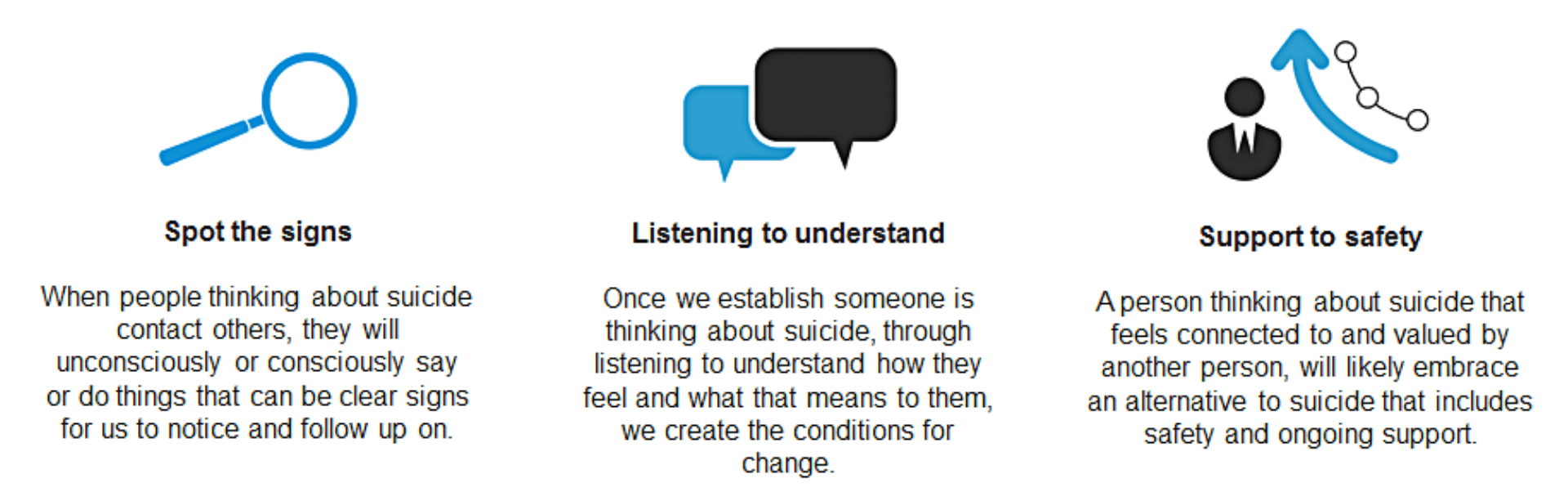

Suicide first aid: Understanding suicide intervention for essential services

One in four frontline collections staff report that in the last 12 months they have spoken to at least one customer they seriously believe might be at risk of suicides. These conversations can be challenging and difficult for everyone involved.

The Money Advice Trust has partnered with the National Centre for Suicide Prevention Education and Training, to deliver a course tailored to financial services.

Our programme equips frontline staff with the skills and confidence to intervene. The focus is on immediate safety, not fixing problems or trying to deliver therapeutic interventions. The skills we teach can be mastered by anyone.

Our training approach towards suicide intervention is practical, taking into account the outcomes your staff are looking to achieve, your organisational needs and existing policies and procedures around suicide and staff safety. We will work with you and your staff to equip them with the skills and confidence and to have a conversation that could save a life.

The three stages of supporting a customer in crisis:

Our Suicide First Aid programme

Aim: To provide staff with the knowledge and practice of suicide intervention skills, which can be applied in any essential services setting – financial, energy, water and telecommunications.

Who is it for? Frontline staff, customer-facing staff, escalation points, team leaders.

Training options available:

- Full-day course

- Half-day course

- In-house course

- Public course – Find out more about our March 2023 session

- Consultancy options

What’s covered?

- The impact and value of personal and professional experience with suicide

- Barriers that prevent people at risk seeking help

- Prevalence of suicidal thoughts and behaviours

- Identification, talking and keeping customers and staff safe

- Escalation to specialist staff/team managers and external agencies when required

- The Signs of Suicide and the Suicide-Safety Guide

- Partnership working and community resources

- Throughout this course we keep a keen eye on self-care.

Stopping the silence and breaking down the stigma of suicide is a key objective of learning in this course.

Benefits to you

- Gain the only national qualification in suicide prevention accredited by City & Guilds ( (option available on completion of full-day course)

- Gain the skills, tools and confidence to help customers with feelings of suicide fairly and consistently

- Meet your legal, regulatory and staff wellbeing responsibilities

Supports all parts of your business (lending, customer service, fraud, retention, collections and digital)

“He called back two days later… and told me that I saved his life. I felt so proud. What he needed was a human being to listen.” – Frontline adviser

Understanding and supporting customers with a serious illness

A serious illness can have a devastating effect on a person and their family, and staff can find these disclosures particularly challenging.

Recent research shows that frontline collections staff will receive an average of 15 disclosures a month about a customer with a serious illness.

Equipping staff to have these conversations and identify and support people who have a serious illness is a vital part of achieving the right outcomes for your organisation and your customers.

Course outline

Aim: To develop your staff to:

- understand why it’s important to take a customer’s serious illness into account;

- handle disclosures of serious illness; and

- deal with potentially difficult circumstances

Who is it for? All front-line, customer-facing staff, management, specialist teams, back-office staff and relevant suppliers.

Training options available

E-learning

Consultancy

What’s covered?

- what is a serious illness?

- What affect does serious illness have on your organisation?

- Common conditions

- How to handle a customer’s disclosure – from initial response to managing the disclosure and adhering to the Data Protection Act

- How to better understand a customer’s situation

- The five components of the TEXAS acronym as a tool for dealing with vulnerable factors

- The four points of the IDEA technique as a tool for understanding the significance of the vulnerability presented

- Strategies for dealing with challenging circumstances, including customers who are in shock, angry or low, customers who may be disabled or carers who make contact

Benefits to you

- Improve your reputation as a responsible organisation that treats customers fairly

- Gain the skills, tools and confidence to handle customers in vulnerable circumstances fairly and consistently

- Improve your debt recovery rates and Improve broken repayment arrangements, and minimise the likelihood of additional financial costs, and a worsening of the customer’s mental health

- Meet your legal and regulatory responsibilities under the Mental Capacity Act and Data Protection Act

- Supports all parts of your business (lending, customer service, fraud, retention, collections and digital)

Identifying and supporting customers with gambling, alcohol and substance dependency

People living with any addiction – be it gambling, alcohol or substance misuse – can have complex and difficult lives. This can easily lead to financial detriment, including over-spending, loss of control and difficulty managing their finances.

Recent research shows that one in four frontline creditor staff find it difficult to talk about the issue of ‘addictions’ with customers – more than any other type of vulnerable situation.

With one in four specialist staff and one in ten frontline staff encountering customers with an addition ‘most days’ or ‘every day’ it is vital staff are able to understand, identify and support customers suffering from an addiction.

Course outline

Aim: To give people the knowledge, skills, and confidence to identify and support customers who are living with a gambling, alcohol or drug addiction.

Who is it for? All frontline, customer-facing staff, management, specialist teams, back-office staff and relevant suppliers.

Training options available

Consultancy

Public session

What’s covered?

- Understand how dependency occurs

- Have reflected on their values and attitudes

- Understand how dependency can affect members

- Be able to identify a member who may be affected by a dependency

- Be able to effectively signpost a member for further support

Benefits to you

- Improve your reputation as a responsible organisation that treats customers fairly

- Gain the skills, tools and confidence to help customers in vulnerable circumstances fairly and consistently

- Improve your debt recovery rates and broken repayment arrangements, and minimise the likelihood of additional financial costs

- Meet your legal and regulatory responsibilities under the Mental Capacity Act and Data Protection Act

- Supports all parts of your business (lending, customer service, fraud, retention, collections and digital)

Coaching and Mentoring following vulnerability training

Coaching and mentoring are pivotal following training because they help bridge the gap between theoretical knowledge and practical application. Training provides the foundational understanding and skills, but coaching and mentoring offer the tailored support needed to navigate real-world challenges.

Our coaching and mentoring course is designed to help team managers, coaches and mentors to help their staff apply the knowledge and skills learnt in the training room and support vulnerable customers more effectively.

Course outline

Aim: To provide the learners with the knowledge and skills to work with their staff to improve how they utilise the skills learnt in our vulnerability training

Who is it for? Team manager, coaching, training or mentoring roles

Training options available

Consultancy

Public session

What’s covered?

- Understand the range of ways to communicate with the learner

- Explore the tools used for a consistent approach

- Recognise the needs of themselves and the wider team

- Know the best way to record this activity

- Be able to embed the tools used for vulnerable customers

Benefits to you

- Improve your reputation as a responsible organisation that treats customers fairly

- Gain the skills, tools and confidence to help customers in vulnerable circumstances fairly and consistently

- Meet your legal and regulatory responsibilities

- Supports all parts of your business (lending, customer service, fraud, retention, collections and digital)

Identifying and supporting customers with mental capacity limitations

Mental capacity limitations can result in customers having significant problems with understanding, remembering, and evaluating information about credit products they are applying for, as well as communicating a decision about this.

Where not identified, these can result in detriment including borrowing, lending and contracts that result in ‘later downstream’ financial difficulty and problem debt.

This course covers practical steps and actions you can take to identify and support customers with mental capacity limitations (and other decision-making difficulties) during credit applications.

Course outline

Aim: To enable those working with customers in the financial services sector to identify and provide the appropriate support to customers with a mental capacity limitation.

Who is it for? This course is designed for those working in financial organisations such as mortgage and loan advisers who regularly come into contact with customers.

Training options available

E-learning

Consultancy

What’s covered?

- Identify what ‘mental capacity’ and a ‘mental capacity limitation’ are

- Recognise ways that a mental capacity limitation can affect a customer’s ability to cope with their finances

- Recognise the ways in which a customer with a mental capacity limitation can be identified and supported

- Identify the key principles of working with customers with a mental capacity limitation

- Identify the key components of the BRUCE tool to be able to apply them

- Identify the components of laws and regulations that apply to mental capacity

Benefits to you

- Improve your reputation as a responsible organisation that treats customers fairly

- Gain the skills, tools and confidence to handle customers in vulnerable circumstances fairly and consistently

- Improve your debt recovery rates and broken repayment arrangements, and minimise the likelihood of additional costs

- Meet your responsibilities under the Financial Conduct Authority’s regulatory frameworks relating to mental capacity, contracting and decision-making, and arrears (CONC and MCOB), as well as wider UK law

- Supports all parts of your business (lending, customer service, fraud, retention, collections and digital)

Understanding and identifying energy customers in vulnerable circumstances

Customer vulnerability is high on the energy industry’s agenda. The Commission for Customers in Vulnerable Circumstances, established by Energy UK, has recently called for immediate action to improve support for energy customers in vulnerable circumstances.

The Commission, chaired by Lord Whitty and comprising five Commissioners, including the then Money Advice Trust chief executive Joanna Elson OBE, published its report in May 2019. The report found that despite some good practice, the energy sector is not regularly meeting the needs of customers and that ‘urgent action’ is required. Energy companies need to ensure they have the right systems, processes and staff training to help customers in vulnerable circumstances.

Course outline

Aim: To enable those working with customers in the energy sector to identify and provide the appropriate support to customers in a vulnerable situation.

Who is it for? This course is designed for those working in energy organisations who regularly come into contact with customers. Such as frontline, customer-facing staff, management, specialist teams, back-office staff and relevant suppliers.

Training options available

E-learning

Consultancy

What’s covered?

- Understand what is meant by consumer vulnerability

- Understand regulatory requirements and best practice for energy companies

- Explore how to identify customers in vulnerable situations by using appropriate questioning techniques

- Understand the Priority Services Register, who is eligible and what services are available

- Explore what support is available to customers in vulnerable circumstances within your organisation and externally

Benefits to you

- Improve your reputation as a responsible organisation that treats customers fairly

- Gain the skills, tools and confidence to handle customers in vulnerable circumstances fairly and consistently

- Improve your debt recovery rates and broken repayment arrangements, and minimise the likelihood of additional costs

- Meet your responsibilities under the Ofgem’s definition of consumer vulnerability and the role of the Priority Services Register as well as wider UK law

- Supports all parts of your business (customer service, retention, collections and digital)

Tailored workshop for handling challenging calls

Throughout this programme staff will be given the knowledge and tools to support customers in a variety of vulnerable circumstances. Cases may still arise where the conversation is challenging, and it is not always clear that the best outcome has been achieved.

This session will be tailored utilising a selection of your pre-selected calls that the teams find challenging. Our Subject Matter Expert will unpack these calls and do a sense check with the team to focus on identification of vulnerability, identifying triggers and utilising tools such as TEXAS, IDEA and BRUCE to manage disclosures. We’ll look at setting our own boundaries and recognising the organisational boundaries we all work to. We’ll identify ways to deescalate difficult situations and hold space for people in crisis whilst protecting ourselves.

Course outline

Aim: This course explores interactions that can be challenging and identifies some specific techniques to handle these. We will have the opportunity to share best practice and discuss these, sometimes difficult, topics in a safe space.

Who is it for? This course is intended for those who are in consumer-facing roles and are likely to encounter and interact with vulnerable consumers.

Training options available

Virtual Classroom

Consultancy

What’s covered?

- Handle challenging interactions using specific tools and techniques for use in the moment

- Recognise the impact of a trigger in your consumer or yourself

- Identify and set important personal and organisational boundaries

- Ways to de-escalate a challenging situation

- Reflect on your own advice practice and ways to develop this

- How to effectively signpost a customer without causing further distress

Benefits to you

- Improve your reputation as a responsible organisation that treats customers fairly

- Gain the skills, tools and confidence to handle customers in vulnerable circumstances fairly and consistently

- The course is hosted online, providing you with a flexible schedule and environment to suit your staff as they can attend from anywhere

- Supports all parts of your business (customer service, retention, collections and digital)

Supporting colleagues: High-impact interactions

Following the COVID-19 pandemic and the current cost of living crisis, frontline staff are encountering an increasing number of consumers in a difficult situation. Many of these interactions can have a high personal, emotional, and practical impact on our staff over time.

It is vital to help your staff recover from these high-impact interactions for their own well-being and so they can help and support the next customer. This course has been designed to provide people managers with the skills to have a conversation with staff members and help them recover.

Course outline

Aim: The aim of this course is to provide learners with the skills to have supportive conversations with their team members following a high-impact event.

Who is it for? This course is intended for people managers whose team are in consumer-facing roles that are likely to encounter and interact with vulnerable consumers

Training options available

Virtual

Face-to-face

What’s covered?

- Be equipped to have supportive conversations with their team members

- Be able to promote colleague resilience in the context of a major impact event

- Share learning from challenging and complex conversations in the context of a major impact event

Benefits to you

- Improve your reputation as a responsible organisation that treats customers fairly

- Gain the skills, tools and confidence to handle customers in vulnerable circumstances fairly and consistently

- Supports all parts of your business (lending, customer service, fraud, retention, collections and digital)

Contact our training team

Interested in our training? Call or email for more information.

Submit a training enquiry

Complete our simple enquiry form to help us meet your training needs and we’ll get back to you shortly.