Vulnerability Resources

Help! What support can firms give disabled consumers and people in vulnerable situations guide

The second edition of its Help! Support Needs Starter Guide – a unique resource that brings together practical support needs for disabled and vulnerable consumers across essential services. This updated guide continues to fill a critical gap in the landscape of consumer support. It describes over 120 support needs already being met across financial services, energy, water, telecoms and retail/delivery sectors – offering a single reference point for firms seeking to improve accessibility and inclusion.

November 2025

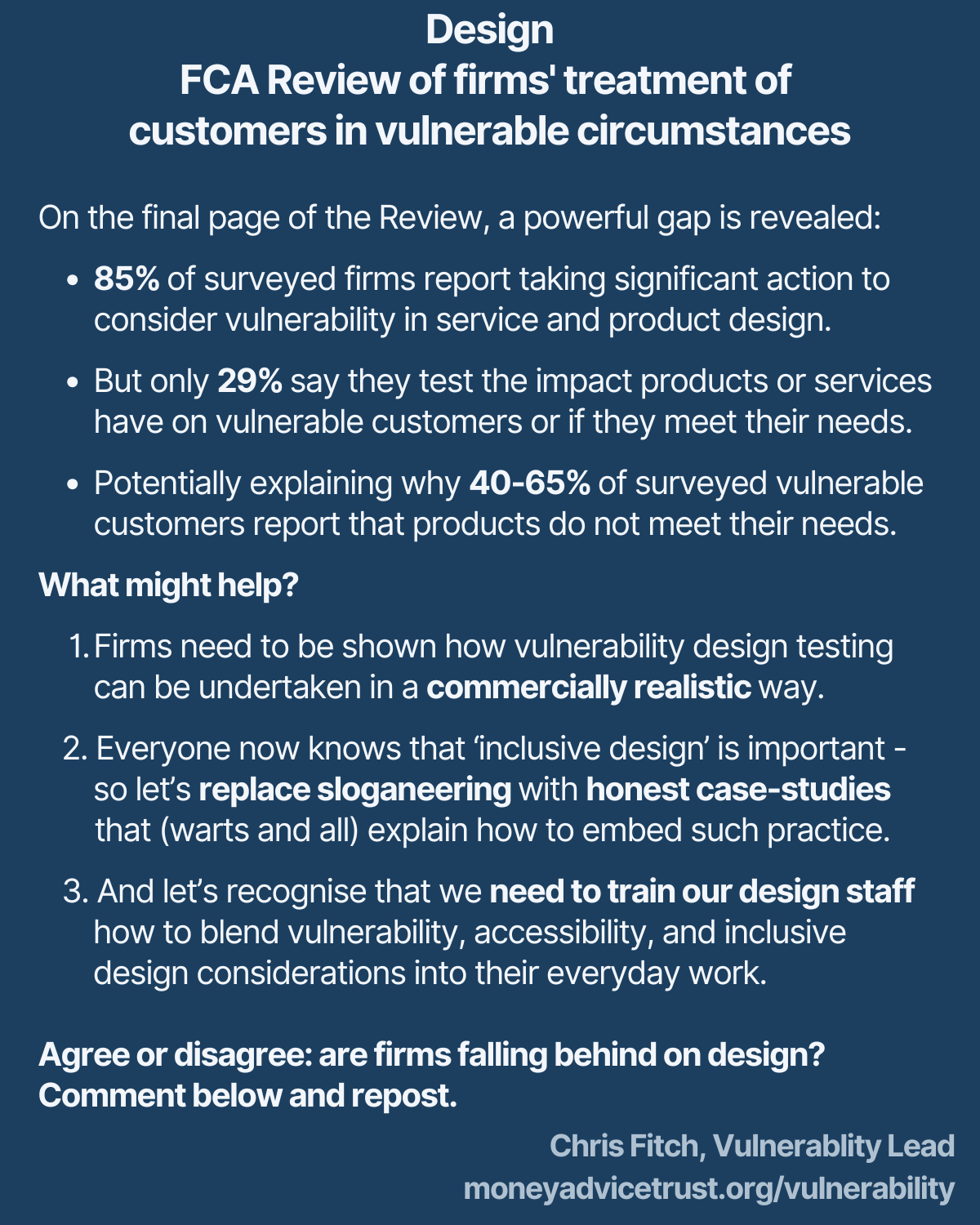

FCA Review: first thoughts, 7th March 2025

FCA Review: first thoughts, 7th March 2025

FCA Review: Outcomes

FCA Review: Design

Five new things the FCA have said about vulnerability

Read five new things that you may have missed that the FCA have said about vulnerability. Taken from our exclusive podcast with the FCA’s Charlotte Clark, Director of Cross-Cutting Policy and Strategy.

April 2025

The Vulnerability Decade: FCA 2014 – today

This guide provides a history of the FCA and vulnerability. All the way from the first-ever FCA definition of vulnerability to their 2025 Vulnerability Review.

April 2025

Vulnerability: The Golden Thread

There is a Golden Thread to addressing Consumer Vulnerability. It involves asking three questions:

1. Vulnerable to what? | 2. Supported how? | 3. If not us, who? Read more about how to make sure all your staff, relative to their role, should be able to answer these questions.

April 2025

Help! What support can firms give disabled consumers and people in vulnerable situations?

Are you looking to improve how your organisation supports its customers? Our guide provides the essential tools and insights needed to deliver effective assistance.

Inside the guide you will find:

- Guidance on effective support: Practical strategies for offering meaningful help to your customers

- How to implement these changes: Suggested approach to make these changes within your organisation

- Further Support: Where you can access further support and guidance

February 2025

A once in 25 years opportunity: ten principles for designing vulnerable consumer data-sharing programmes

The Government are considering how disabled and vulnerable customers’ data could be shared to improve essential service provision across energy, water, banking, and telecommunications. This has sparked a national debate about data-sharing and ‘Tell Us Once’ approaches.

This paper, supported and distributed by the Money Advice Trust in partnership with WhatWeNeed.Support contributes 10 principles – drawn from research, lived experience, and specialists – to design a system that reflects what vulnerable and disabled consumers need from data-sharing, rather than relying on assumptions or technical specifications alone.

May 2024

New guidance: making it easier for consumers to disclose a mental health problem

Many people experiencing a mental health problem find it difficult to disclose their condition to an essential services provider, such as a bank or energy company.

Co-authored by our Vulnerability Lead Consultant, Chris Fitch and in collaboration with the Money and Mental Health Policy Institute, we’ve published new practical guides to help essential services firms support more people with mental health problems to disclose their condition.

Vulnerability: meeting expectations and achieving outcomes

To help firms plan the practical steps they need to continue taking based on the FCA’s finalised vulnerability guidance, we have published a new paper ‘Vulnerability: meeting expectations and achieving outcomes’.

This paper is designed to be a helpful starting point. We take you through each key expectation on vulnerability and outline what this means to your firm, what action you can take to meet the regulator’s expectations and ultimately achieve positive outcomes for your vulnerable customers and your business.

Dependency & Addiction: Understanding how to support customers with gambling, alcohol and substance depedency

First published in 2018, appearing in a section of ‘Vulnerability: the experience of debt advisers’, this report focusses specifically on dependency and addiction and what organisations can do to support customers dealing with these issues.

If you’re interested in learning more about dependency and addiction, find out more about our course led by Jamie Compton-Rea – Supporting customers with gambling, alcohol and substance dependency.

April 2024

New guidance: inclusive design in essential services

Inclusive design is increasingly recognised as a way to ensure markets are fair and inclusive, especially for customers in vulnerable circumstances. With an increasing focus on inclusive design from industry, regulators and firms, the Money Advice Trust has launched two reports in partnership with Fair By Design to help firms and regulators understand and translate inclusive design into practical action.

January 2021

Vulnerability, GDPR, and disclosure: practical guidance for creditors and advisers

The Money Advice Trust and the Money Advice Liaison Group (MALG), have launched a new series of guides to help firms meet data protection regulation and support customers in vulnerable circumstances. The guides are designed to help creditors and advisers understand the overlap between GDPR and vulnerability, and strike the right balance between human experience and data.

November 2020

The need to know: understanding and evidencing customers’ mental health problems

This free guide, produced by the the Money and Mental Health Policy Institute and the Money Advice Trust, is designed to help creditors support customers affected by debt and mental health problems.

The guide features detailed information about how specific mental health conditions may affect a customers’ ability to manage money and provides practical advice on areas including:

- how to get the best out of conversations with customers about their experience of mental health problems

- When it is appropriate to ask for further evidence about a customer’s mental health problem, and when this may be the wrong course of action.

The Need to know guide for creditors is supported by UK Finance.

February 2020

Dealership guide: decision-making when purchasing a vehicle

The dealership guide, Decision making when purchasing a vehicle was written by the Money Advice Trust’s vulnerability experts, Chris Fitch and Colin Trend, with the support of Santander Consumer Finance. The guide outlines the role and responsibilities of credit intermediaries, such as car dealerships, when identifying and supporting customers who may have difficulty with decision-making.

The guide covers key topics including: how customers make decisions, identifying decision-making problems, supporting customers with problems, applying key principles and law and regulation. The guide is designed for staff who engage with customers or have a responsibility for customer vulnerability strategies.

July 2023

Supporting business customers in vulnerable circumstances

Much of the work within vulnerability so far has taken place in the person, rather than business customer space. Given the importance of small businesses to the UK economy, understanding the nature and impact of vulnerability within this context is crucial.

The Lending Standards Board (LSB) and Money Advice Trust have published Supporting business customers in vulnerable circumstances, a joint report exploring vulnerability in this important context.

The report combines insight from LSB-registered firms together with the experiences of callers to Business Debtline, the Money Advice Trust’s free advice service for small business owners.

July 2018

Lending and vulnerability: an introductory guide to mental capacity

Supporting customers in vulnerable circumstances can be a challenge for many organisations. Mental capacity limitations are an aspect of vulnerability that is evident when a customer finds it difficult (and sometimes impossible) to understand what they are applying for, and make a decision about a product or service. Tackling the issue of ‘mental capacity’ can be daunting for any organisation. This is often due to the terminology, regulatory guidance, and legal frameworks that surround mental capacity.

This introductory guide, authored by the Money Advice Trust’s vulnerability lead Chris Fitch and building on 2017 research by the University of Bristol’s Personal Finance Research Centre (funded by the Finance and Leasing Association and UK Cards Association), aims to cut through this by clearly explaining how firms can practically identify and support customers with a mental capacity limitation.

March 2018

Vulnerability, mental health, and the energy sector: a guide to help identify and support consumers

This guide, by the Money Advice Trust and Energy UK, aims to help better identify and support consumers in vulnerable circumstances. It provides practical tools for front-line staff to use with consumers in a range of vulnerable situations.

Written for Energy UK by the Money Advice Trust vulnerability leads Chris Fitch and Colin Trend, the guide draws on the charity’s experience of working with collections staff to improve the experience and outcomes for customers with mental health problems and in other vulnerable circumstances.

Consumer vulnerability is high on the energy industry’s agenda following Ofgem’s recently modified domestic Standards of Conduct requiring gas and electricity suppliers to better identify consumers in vulnerable situations. With the number of energy suppliers increasing, this guide comes at an important time to assist energy suppliers in training staff to improve their support to customers.

In addition to covering a range of vulnerable situations, it also includes specific guidance on helping consumers with mental health problems or mental capacity limitations.

October 2017

Vulnerability: a guide for lending

Mental capacity limitations can result in customers having significant problems with understanding, remembering, and evaluating information about credit products they are applying for, as well as communicating a decision about this.

Where not identified, these can result in detriment including borrowing, lending and contracts that results in ‘later downstream’ financial difficulty and problem debt.

Vulnerability: a guide for lending, written by the Trust’s vulnerability leads Chris Fitch and Colin Trend, with Jamie Evans for the University of Bristol’s Personal Finance Research Centre, identified that by extending focus on to credit applications, firms can reduce the potential risk of detriment and offer support. The guide, supported by the Finance & Leasing Association and The UK Cards Association, offers practical tools to identify and support customers with mental capacity limitations.

June 2017

Vulnerability: a guide for debt collection

Written by the Trust’s vulnerability leads Chris Fitch and Colin Trend with, Jamie Evans for the University of Bristol’s Personal Finance Research Centre, this guide is an evolution of the widely-used ‘12 steps’ guide first published by the Money Advice Trust and the Royal College of Psychiatrists.

This guide, supported by the Finance & Leasing Association and The UK Cards Association, throws a welcome spotlight on a broader range of vulnerable circumstances that can affect indebted customers such serious illnesses, addictions and those customers that disclose thoughts of suicide.

March 2017

Vulnerability Matters podcast

Welcome to the Vulnerability Matters podcast from the Money Advice Trust. A series that examines from a range of perspectives how firms support consumers in vulnerable situations and provides you with the practical tips and guidance to achieve positive outcomes within your own organisation.

The podcasts are also available to stream for free on Spotify, Apple Podcasts, Stitcher Amazon music and Spreaker.

Want to make all of our episodes available to your staff? Hosting our podcasts on your intranet page is a great way to enhance cross organisation awareness of vulnerability and the importance of supporting vulnerable customers. Contact us today if you would be interested in hosting our podcast for your organisation’s pages or platforms.

New Podcast Series

In this new season, each episode is presented in a shorter 20 minute format with a focus on a guest who will change the way that you think and act on vulnerability. The series covers issues ranging from stammering to chronic pain, empathy to loneliness, and fuel poverty to consumer psychology.

If you work in financial services, energy, water, telecommunications, government, or any other essential service sector, this series will be relevant to you.

-

Episode 60: The Stratford Lotus (and other Financial Lives Survey gems) with Sarah Montgomery, FCA

Listen to episode - Download episode

-

Episode 59: Vulnerability Voices: Convicted customers with Lindsey, Sage and Three Hands Insight

Listen to episode - Download episode

-

Episode 58: Abhorred but ignored? Economic abuse and older customers. With Richard Robinson

Listen to episode - Download episode

-

Episode 57: How I lost more than my money: Scamming secrets. With Lin and Lou Baxter

Listen to episode - Download episode

-

Episode 56: How I stole millions: Scamming secrets. With Alex Wood

Listen to episode - Download episode

-

Episode 55: Vulnerability Voices: How serious illness impacted Anne and Robert. With Michael Hilton from Three Hands

Listen to episode - Download episode

-

Episode 54: Outcomes: A new hope. With David Atkins from Money Advice Trust

Listen to episode - Download episode

-

Episode 53: Is the Purple Pound really worth £446bn? With Mike Adams and Jamie Evans

Listen to episode - Download episode

-

Episode 52: I dare you to define it: Financial Wellbeing With Professor Adele Atkinson

Listen to episode - Download episode

-

Episode 51: Avengers Assemble! Build your own Champions Network With Charlie Turrell

Listen to episode - Download episode

-

Episode 50: Vin-fluencers: Who can we trust? With Matt Gupwell

Listen to episode - Download episode

-

Episode 49: Is ‘trauma’ our responsibility too? With Rachel Edwards

Listen to episode - Download episode

-

Episode 48: Loopholes, crypto and gambling with Raminta Diliso and Jason

Listen to episode - Download episode

-

The Art of Listening presented by Dr Elizabeth Blakelock

Listen to episode - Download episode

-

The Inclusion Outcomes presented by Dr Elizabeth Blakelock

Listen to episode - Download episode

-

The Inclusion Allies presented by Dr Elizabeth Blakelock

Listen to episode - Download episode

-

Episode 47 – More light, more heat? Ofgem’s new vulnerability strategy with Beth Martin

Listen to episode - Download episode

-

Economic abuse: Will UK Finance’s 2025 Code help with Dr Nicola Sharp-Jeffs and Chris Fitch.

Listen to episode - Download episode

-

Episode 46 – Economic abuse: The woman who changed everything, with Dr Nicola Sharp-Jeffs

Listen to episode - Download episode

-

Episode 45 – Inclusive design stop talking, start doing. With Jo Ellis (Tesco) and Katherine Snow (Nile)

Listen to episode - Download episode

-

Episode 44 – COGA – design’s best kept secret? With Lisa Seeman-Horwitz

Listen to episode - Download episode

-

Episode 43 – Does anyone know what ‘financial inclusion’ actually means with Howard Taylor

Listen to episode - Download episode

-

Episode 42 – What makes an adjustment reasonable? With Maria Orchard and Naomi Aziz

Listen to episode - Download episode

-

Episode 41 – Vulnerability isn’t just a duty – it’s a movement with Lee Healey

Listen to episode - Download episode

-

Episode 40 – Does AI ‘get’ vulnerability? With Savannah Price and Dan Holloway

Listen to episode - Download episode

-

Episode 39 – When innovation excludes? Touchscreen payment devices and disabled consumers with Dr Amy Kavanagh and Adam Scarrott

Listen to episode - Download episode

-

Episode 38 – How to get into prison with Matt Dronfield

Listen to episode - Download episode

-

Exclusive FCA interview: Vulnerability Review findings with Charlotte Clark

Listen to episode - Download episode

-

Episode 37 – Not my problem? Why signposting has to change with Cat Divers

Listen to episode - Download episode

-

Episode 36 – Help! A new approach to support with Christine Tate and Dan Holloway

Listen to episode - Download episode

-

Episode 35 – Do you want to build an Empth Lab? With Shaun Conner, Government Digital Service

Listen to episode - Download episode

-

Episode 34 – High-impact interactions: how do we recover? With Andy Langford and Chris Fitch

Listen to episode - Download episode

-

Episode 33 – So…what does 2025 hold for consumer vulnerability? With Grace Brownfield and Phil King

Listen to episode - Download episode

-

Episode 32 -“The Experiment We Never Knew We Needed” with Katie Orme, Octopus Energy

Listen to episode - Download episode

-

Episode 31 – ‘ Digital poverty’ doesn’t mean what you think with Elizabeth Anderson

Listen to episode - Download episode

-

Episode 30 – There’s more to blind customers than Braille with Holly Tuke

Listen to episode - Download episode

-

Episode 29 – How do I get a customer to disclose? With Alexis Stevens from Money and Mental Health.

Listen to episode - Download episode

-

Episode 28 – How do 999 staff talk to vulnerable callers? With Mike Modder-Fitch and Chris Fitch

Listen to episode - Download episode

-

Episode 27 – How we make “Easy Read” documents in seconds with Annie Baker, Tom, and Lilly

Listen to episode - Download episode

-

Episode 26 -Just what do I say to a terminally ill customer? With David Williams from Marie Curie

Listen to episode - Download episode

-

Episode 25 – Is ‘ableism’ more than another buzzword? With Celia Chartres-Aris and Chris Fitch

Listen to episode - Download episode

-

Episode 24 – Hidden disability, looking behind the Sunflower Lanyard scheme with Paul White

Listen to episode - Download episode

-

Episode 23 – The secret life of accessible numbers with Laura Parker and Chris Fitch

Listen to episode - Download episode

-

Episode 22 – Am I making things better for disabled customers? With Kathryn Townsend and Chris Fitch

Listen to episode - Download episode

-

Episode 21 – ‘Good’ and ‘bad’ disability design – Liz Jackson’s 5 point check-list

Listen to episode - Download episode

-

Episode 20 – Crisis conversations and digital channels with Victoria Hornby from Shout

Listen to episode - Download episode

-

Episode 19 – Being vulnerable, while working in vulnerability with Makedah Simpson and Rosie Lyon

Listen to episode - Download episode

-

Episode 18 – Dependency with Jamie Compton-Rea and Chris Fitch

Listen to episode - Download episode

-

Episode 17 – Being a carer with Trevor Salomon and Chris Fitch

Listen to episode - Download episode

-

Episode 16 – Tackling loneliness with Amy Perrin and Chris Fitch

Listen to episode - Download episode

-

Episode 15 – Visible difference with Sudha Vijay, Jane Rodrick, Michaela Baker and Chris Fitch

Listen to episode - Download episode

-

Episode 14 – Hearing Loss and d/Deaf customers with Tim Scannell and Chris Fitch

Listen to episode - Download episode

-

Episode 13 – Lived experience with Dan Holloway and Chris Fitch

Listen to episode - Download episode

-

Episode 12 – Building Trust with Charlie Nixon and Chris Fitch

Listen to episode - Download episode

-

Episode 11 – Stammering with Lyndsay Edgington and Chris Fitch

Listen to episode - Download episode

-

Episode 10 – What is empathy with Mathieu Lajante and Chris Fitch

Listen to episode - Download episode

-

Episode 9 – Firewalking with Lee Walls and Chris Fitch

Listen to episode - Download episode

-

Episode 8 – Supporting non-verbal customers with Katie Mackay, Jack Hatcher and Chris Fitch

Listen to episode - Download episode

-

Episode 7 – Refugees and asylum seekers with Joshua Aspden and Chris Fitch

Listen to episode - Download episode

-

Episode 6: Making decisions with Tim Farmer and Chris Fitch

Listen to episode - Download episode

-

Episode 5: Tone of voice with Steve Donovan and Chris Fitch

Listen to episode - Download episode

-

Episode 4: Being Cold with Dr Rose Chard and Chris Fitch

Listen to episode - Download episode

-

Episode 3: Chronic Pain with Dr Elizabeth Blakelock and Chris Fitch

Listen to episode - Download episode

-

Episode 2: Vulnerability trends in 2023/24

Listen to episode - Download episode

-

Episode 1: Trans customers with Sarah Stephenson-Hunter and Chris Fitch

Listen to episode - Download episode

Video Podcasts & Webinars

Recap on video recordings of our Vulnerability Matters podcast, and webinars featuring a range of expert speakers and panellists on a wide range of topics:

Vulnerability Matters Podcast:

Episode 14: Hearing loss and d/Deaf customers with Tim Scannell and Chris Fitch

Webinars:

Mental Health Awareness Week 2024: Navigating Mental Health and Finances (in collaboration with the Money and Mental Health Policy Institute)

Subscribe to our podcast

Subscribe to our Vulnerability Matters newsletter to be notified of newly available podcasts and webinar recordings.

Vulnerability cards

These eight cards contain useful tools to enable your staff to identify and support customers in vulnerable circumstances.

Every card has an eye-catching icon with key practical ideas and reminders. Developed by the Trust’s vulnerability leads Chris Fitch and Colin Trend, these cards draw on ‘tools’ such as TEXAS (when a customer tells you about themselves) and BRUCE (for customers experience a mental capacity limitation), to ways to handle a crisis and key legislation and guidelines.

If you are interested to preview or order these cards for your teams, please email training@moneyadvicetrust.org.

Seen elsewhere: vulnerability resources

The Money Advice Trust is committed to improving outcomes for customers in vulnerable circumstances. We work with creditors, regulators, trade bodies, business and government across the UK to improve practice.

Here you will find a range of useful resources from different organisations. These resources may not have been published by the Money Advice Trust but they have been designed to help creditor staff, help their customers in vulnerable circumstances.

The Vulnerability Decade: FCA 2014 – today

Our guide provides the history of the FCA Vulnerability review

March 2025

The vulnerability and inclusion handbook and workshop guide – Capital One

The Vulnerability and Inclusion Handbook (and accompanying workshop guide) is not a publication that the Money Advice Trust wrote or developed, but it is an important one that organisations need to know about. Overseen by Tim Hawley at Capital One, and partly inspired by Capital One’s experiences in the Trust’s Vulnerability Academy partnership with UK Finance, it provides practical guidance on what ‘good’ looks like when it comes to product design, vulnerability, and inclusion.

Vulnerability: a guide for lending

Mental capacity limitations can result in customers having significant problems with understanding, remembering, and evaluating information about credit products they are applying for, as well as communicating a decision about this.

Where not identified, these can result in detriment including borrowing, lending and contracts that results in ‘later downstream’ financial difficulty and problem debt.

Vulnerability: a guide for lending, written by the Trust’s vulnerability leads Chris Fitch and Colin Trend, with Jamie Evans for the University of Bristol’s Personal Finance Research Centre, identified that by extending focus on to credit applications, firms can reduce the potential risk of detriment and offer support. The guide, supported by the Finance & Leasing Association and The UK Cards Association, offers practical tools to identify and support customers with mental capacity limitations.

June 2017

Vulnerability: a guide for debt collection

Written by the Trust’s vulnerability leads Chris Fitch and Colin Trend with, Jamie Evans for the University of Bristol’s Personal Finance Research Centre, this guide is an evolution of the widely-used ‘12 steps’ guide first published by the Money Advice Trust and the Royal College of Psychiatrists.

This guide, supported by the Finance & Leasing Association and The UK Cards Association, throws a welcome spotlight on a broader range of vulnerable circumstances that can affect indebted customers such serious illnesses, addictions and those customers that disclose thoughts of suicide.

March 2017

Contact Us

Complete our simple enquiry form to help us meet your training and consultancy needs and we’ll get back to you shortly.